Green Revenue &

Financial Performance

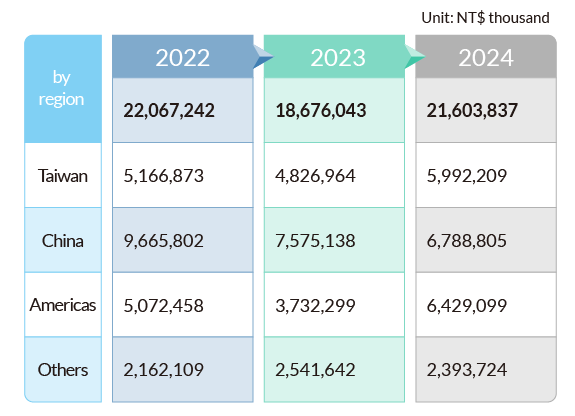

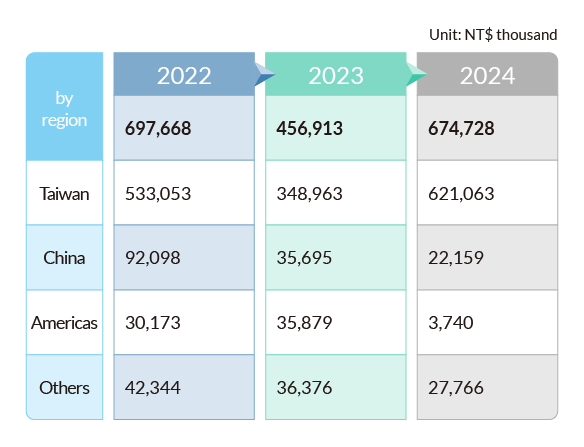

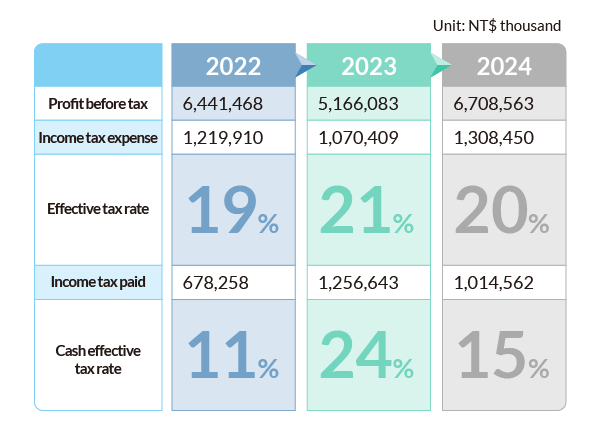

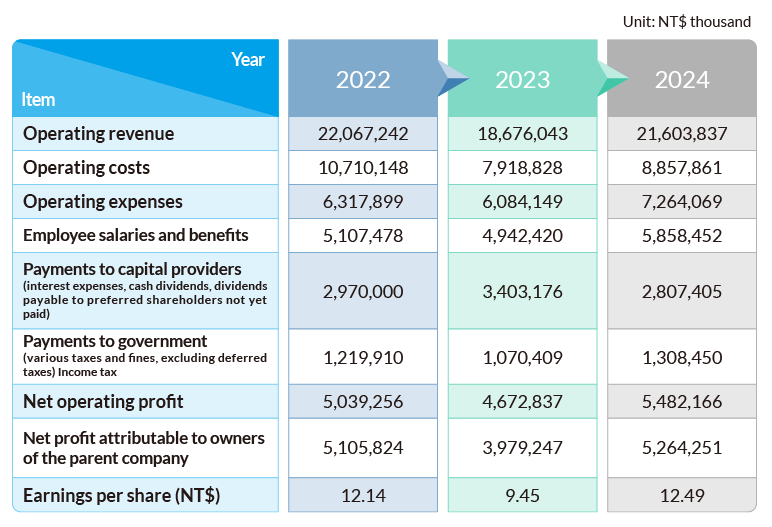

Chroma ATE Inc.’s financial performance in 2024 was outstanding, with both revenue and profits reaching record highs. Revenue amounted to NT$21,603,837 thousand, an increase of 16% over 2023.

Chroma is committed to becoming a world-class enterprise. While operating globally, it actively responds to the impacts of global warming by promoting green and environmentally friendly measures through R&D, manufacturing, products, and services. To meet customer demands for green products, the Company not only reduces the energy consumption of its equipment but also actively develops energy recovery equipment that recovers energy traditionally dissipated as heat back to the power grid, significantly reducing energy usage. In addition, Chroma continuously enhances the accuracy, testing speed, and reduction of size and weight of its testing equipment developed in-house to help users improve production efficiency. All of the above actions demonstrate Chroma’s efforts as a member of the global community to address the threat of global warming.

Looking ahead, Chroma expects that in 2025, the main growth momentum will continue to come from semiconductor and photonics testing solutions. Advanced packaging application measurement equipment certified by customers will begin contributing to revenue on a quarterly basis starting this year. Additionally, its measurement and automated inspection equipment is expected to transition from stabilization to growth this year.

Chroma is optimistic that AI/high-performance computing (HPC) chips, optimized and upgraded automotive and graphics card chips, and expanded ASIC capacity will continue to drive demand for SLT testing equipment. The newly launched one-stop turnkey solution for AR glasses production and manufacturing was adopted by customers in the second half of last year and has begun deliveries, with related supply demand expected to continue through 2025.

Founded in 1984, Chroma ATE Inc. celebrated its 40th anniversary in 2024. The Company markets its own brand “Chroma” globally, acting as a driving force behind emerging technology industries and a trusted partner to world-class clients. With precision measurement and intelligent automation comprehensive solutions, Chroma leads emerging technologies toward innovation. Major market applications include AI, semiconductors/IC, energy storage, electric vehicles, green energy batteries, LED, solar energy, photonics, flat panel displays, video and color, power electronics, passive components, electrical safety, thermoelectric temperature control, automated optical inspection, intelligent manufacturing systems, clean technology, and smart factory fields. Chroma devotes a great deal of investment and resources in research and development every year in order to sustain its leading key technologies and highly integrated capabilities in the optical, mechanical, electronic, temperature control and software fields, to retain competitive advantages and achieve the company's goal of sustainable business operations.

With the rise of generative AI driving demand for high-performance computing, the demand for peripheral system components and related applications has also increased. Among these, the resulting demand for semiconductor component testing has naturally become highly significant. In addition to its leadership in the power measurement market, Chroma also holds a strong position in the key semiconductor component testing field.

Overall, while Chroma is already one of the major global players in the ATE market, the Company continues to proactively respond to market trends and customer needs, targeting high-growth potential applications in the semiconductor sector to expand its market presence. One of Chroma’s key strengths lies in its highly efficient platform conversion support, which sets it apart in the industry. The Company is well-positioned to maintain steady performance and leadership in the fields of AI, the Internet of Things (IoT), and third-generation semiconductor testing. With operational sites across Europe, the Americas, Japan, Korea, China, and Southeast Asia, Chroma leverages innovative technologies to deliver enhanced value and responsive services to its global customer base.

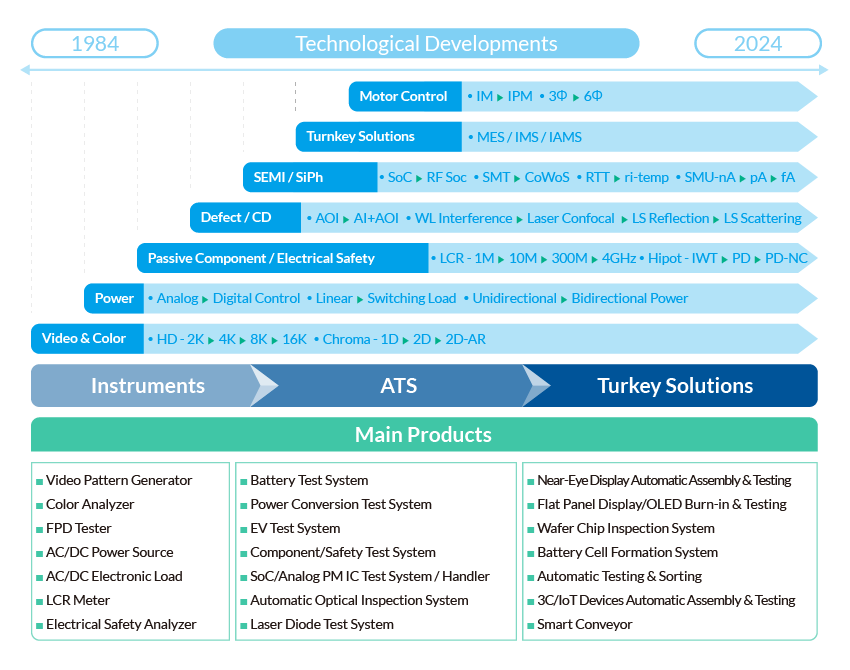

Chroma’s product line and technology primarily encompasses:

1. Measurement Instruments: Belonging to the test instrument sector within the information electronics industry, with customers spanning the monitor industry, power supply industry, passive component industry, LCD module industry, LED industry, semiconductor industry, solar industry, and electric vehicle industry, providing them with instruments for product testing and verification.

2. Automation Equipment: Combining measurement equipment, automation systems, and MES software capabilities to provide customers with integrated automation solutions (Turnkey Solutions). The Company’s main products include automated production and system integration for solar module lines, automated production and system integration for TFT-LCD, battery module automatic test systems, and cleanroom equipment planning and system integration, among various integrated solutions.

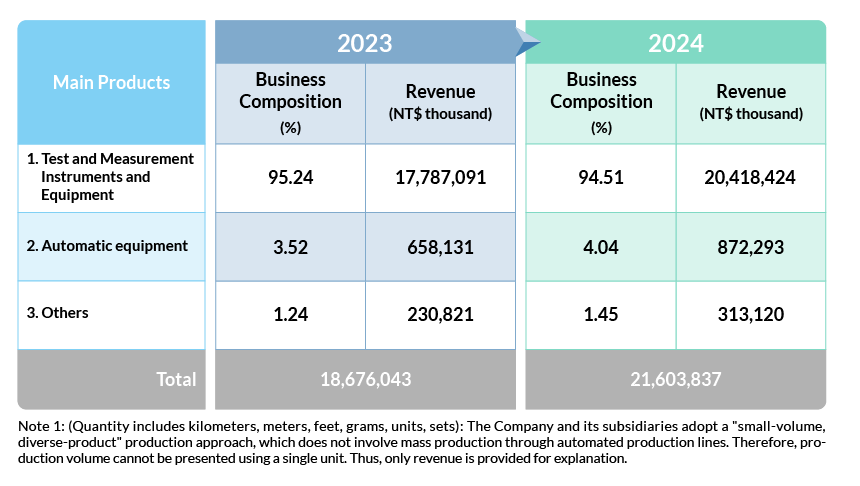

In 2024, the revenue composition by product was 95% from test instrument equipment, 4% from automatic equipment, and 1% from others.

The overall business scope of the Company and its affiliated enterprises mainly focuses on “professional manufacturing services of measurement instruments,” with a small portion of affiliated enterprises engaged in “investment business” as their business scope. Overall, the division of work and interactions among affiliated enterprises are based on mutual support in technology, production capacity, marketing, and services, creating maximum synergy. This enables the Company to continuously provide its global customers with the best "professional measurement instrument manufacturing services," ensuring its leading position in the global market.

Chroma started with display testing, with a vision of developing precise, reliable, and unique testing instruments, and has gradually expanded into nine major product categories, including power electronics, passive components, and semiconductor and IC design testing. To meet customer demands for green products, the Company not only reduces the energy consumption of its equipment but also actively develops energy recovery equipment that recovers energy traditionally dissipated as heat back to the power grid, significantly reducing energy usage. In addition, Chroma continuously enhances the accuracy, testing speed, and reduction of size and weight of its testing equipment developed in-house to help users improve production efficiency. All of the above actions demonstrate Chroma’s efforts as a member of the global community to address the threat of global warming.

Financial Performance

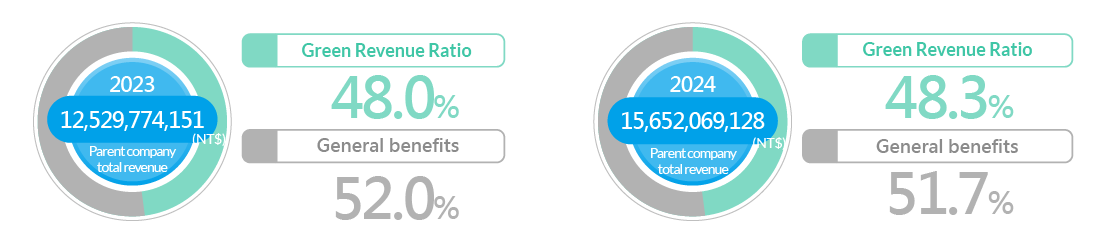

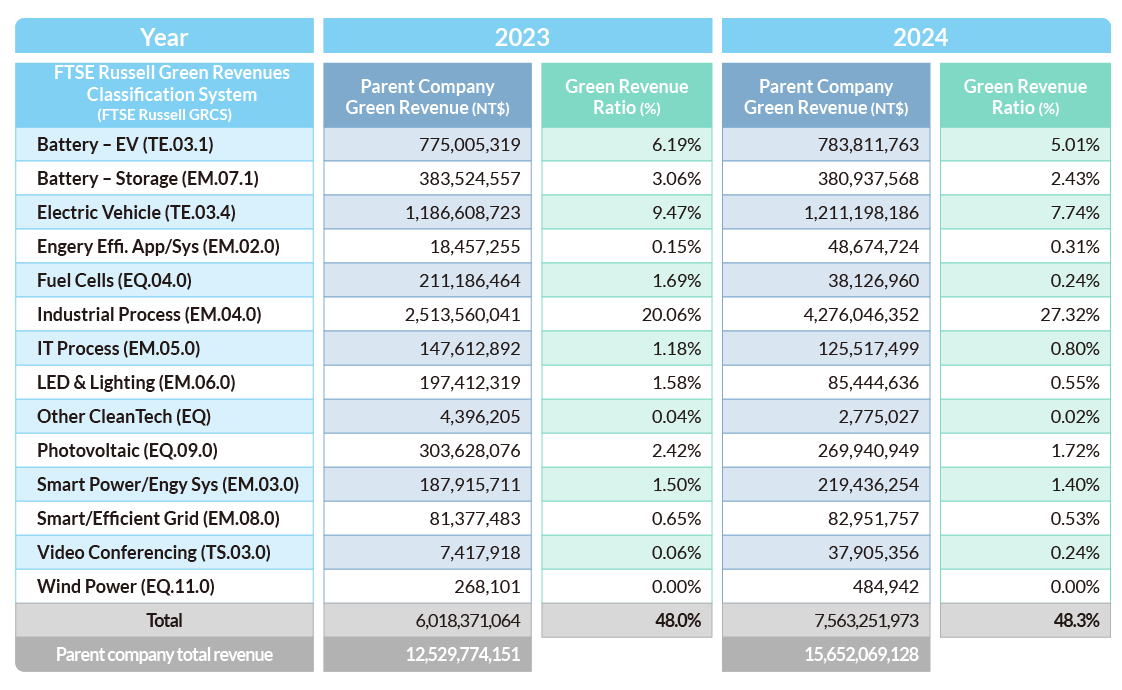

Green Revenues

2. EM energy management & efficiency improvement accounted for 33.34%: including energy storage batteries, energy-saving appliances/lighting, power management, smart grids/meters, smart manufacturing, intelligent information management, etc.

3. EQ renewable energy supply chain equipment accounted for 2.21%: including fuel cells, solar photovoltaics, renewable energy, etc.

Chroma’s ESG efforts encompass five key areas: technology/products, supply chain/manufacturing, healthy and friendly workplace, social impact, and sustainable environment, driving sustainable corporate growth and building a green Chroma.

In 2024, green revenue accounted for 48.3% of the parent company’s revenue. Internally, the Company promotes a Green Chroma Label system to encourage employees to develop testing and automation solutions that help customers save energy and reduce carbon emissions. Starting from its core measurement business, Chroma supports the industry’s net-zero transition and helps create a better world.